Are Business Cards a Marketing / Advertising Expense?

adminShare

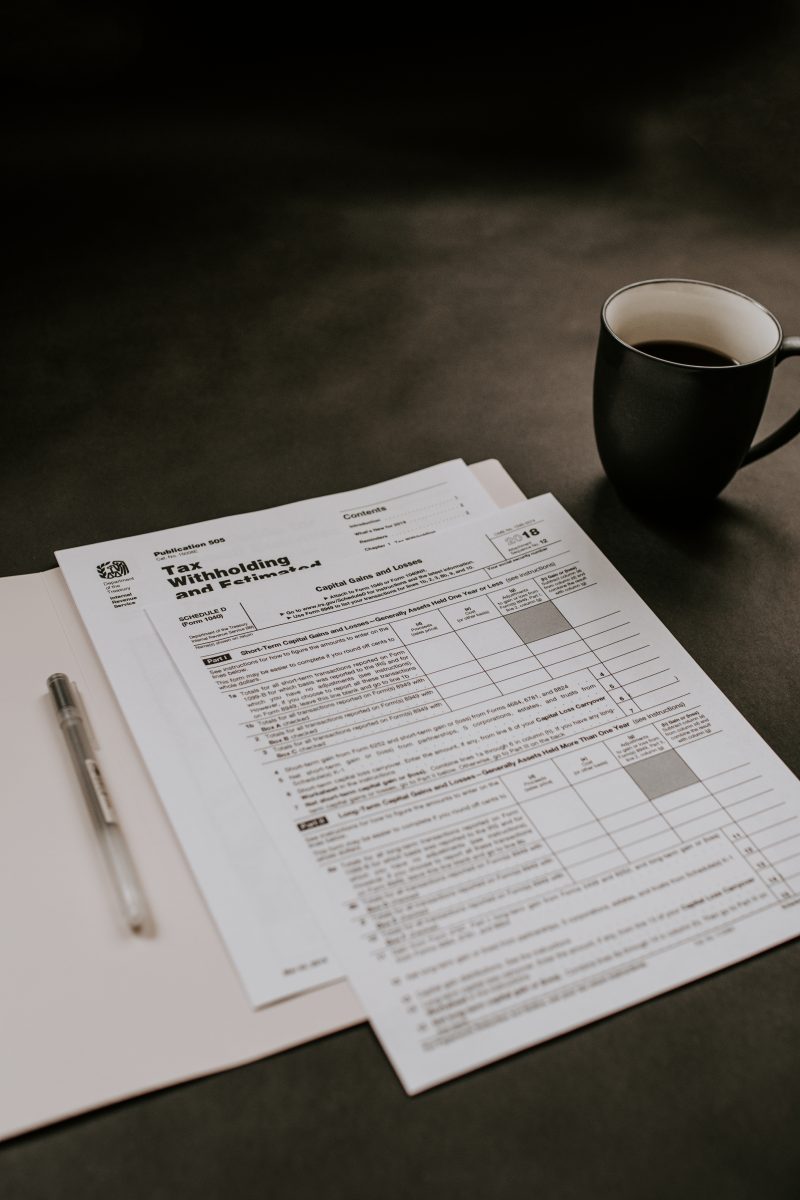

A host of responsibilities fall under the mentally resilient shoulders of business owners. Filing taxes is one of these, and it requires a fair bit of understanding.

When you’re calculating the tax returns for your company, you have to be well cognizant of what constitutes as a business expense. The Internal Revenue Service has provided a clear categorization of taxable and non-taxable business expenses.

It’s highly important that you file your returns properly. Failure to do so may lead to penalties and interest payments, and also a missed chance to save valuable sums in the form of deductibles.

Marketing and Advertising Expenses According to the IRS

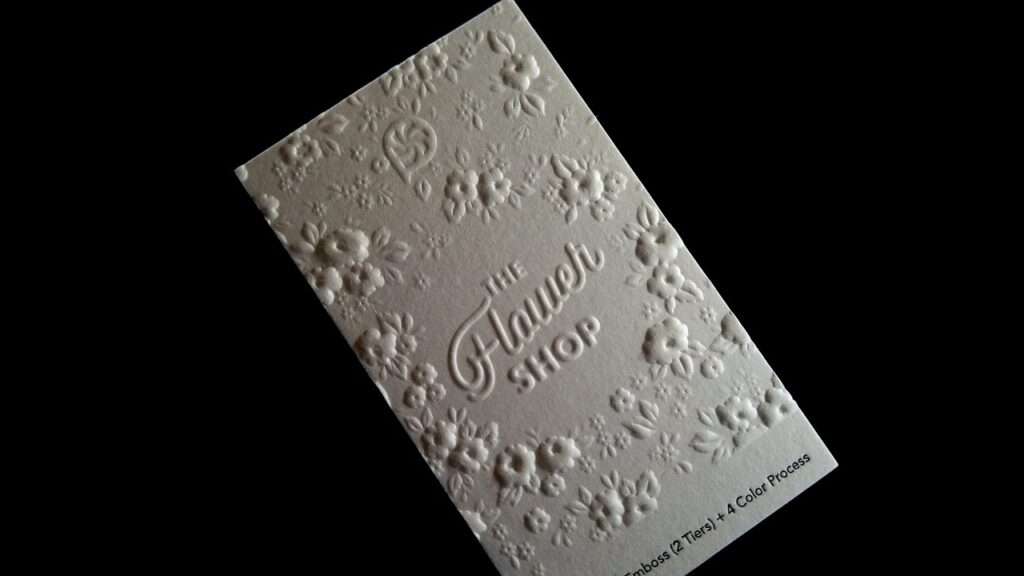

The basic problem with filing is the decision to file the business card expense under the right choice. Some options that seem appropriate are supplies, professional services, and advertising. The most obvious option among these, according to most accountants, is advertising. This is due to the fact that you hand out business cards to potential clients, and therefore promote your business, essentially making it a promotional or advertising material in the process.

Any Promotional Material is considered as an Advertising or Marketing Deductible

The best way to pick the right category for your business expenses is to understand its function. If it’s performing the important function of generating leads for your business, then whether it is a business card or some other material, it’s going to go under the category of marketing or advertising expenses.

In the profit and loss section of your tax return form, the IRS considers the majority of advertising costs as business expenses. This helps you keep your tax liability to a minimum.

But it’s not as simple as that. There are other considerations.

There are some advertising costs that aren’t liable for the same deductibility.

Although you can consider market research a deductible expense, under the guise of marketing expenses, you cannot, however, deduct advertising costs contributing to the research and development of your new services or products.

For example, if you’re finding the right design and theme for your product, and there are costs associated with it, that’s going to count as a deductible expense. However, you can’t factor in the price of the theme itself as a deductible.

Other similar non-deductible advertising expenses include any activity that falls under the umbrella of “personal”. Some examples include the paid meals to a client that you’ve invited on a family event or if you’ve taken him to a basketball game.

Your website is considered an advertisement. However, in the case of an e-commerce website, it’s categorized as a selling business expense, as it has a shopping cart, which is a fundamental selling element.

Furthermore, temporary signs are counted as an advertising expense, whereas, signs that have been up there for years, are non-advertising, and in turn, non-deductible as an advertising expense.

Examples of Marketing Expenses

The IRS has made clear as to what a promoting and non-promoting business expense is. Here’s an extended list of advertising expenses.

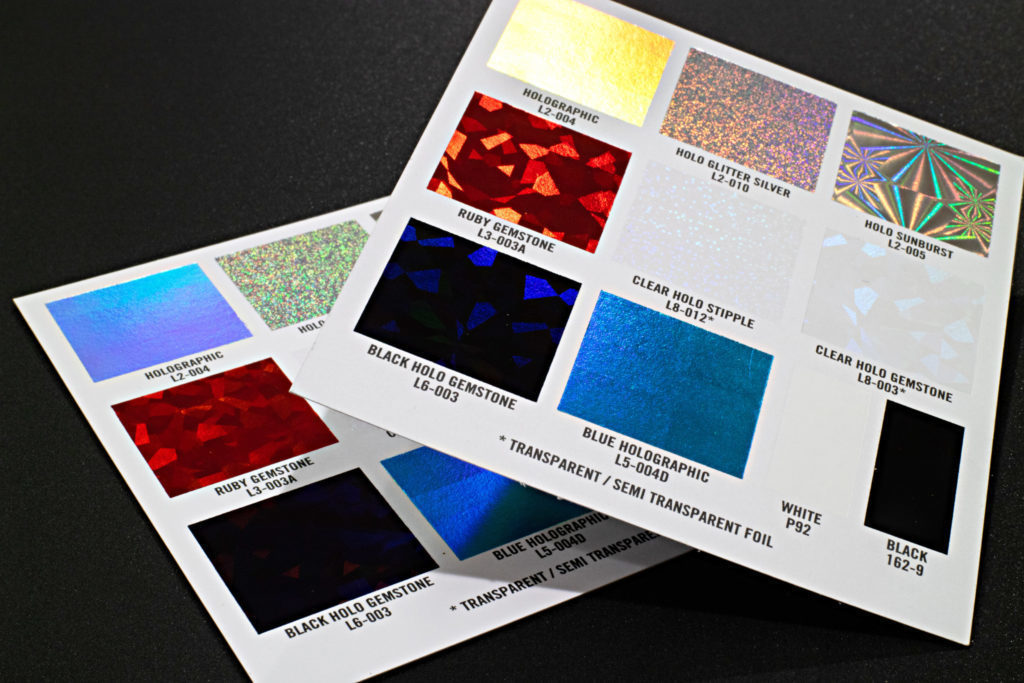

- Business cards

- Domain names

- Print advertising

- Website hosting services

- Video production costs

- Radio ads

- Television commercials

- Market research

- Public relations costs

- Printed promotional materials such as pens, mugs, bookmarks, memo pads, etc.

- Pay-per-click (PPC) advertising

- Social media advertising

- Marketing department salaries

- Email newsletter

- Direct response marketing

- Billboards

- Advertisements on vehicles

- Catalog

- Yellow Page advertising

- Brochures

- Website setup costs

- Special event advertising costs

- Sponsoring local events

- Meals and entertainment costs for special events

Business Cards ARE an Advertising Expense

Marketing is a vast sea of promotional strategies that generate leads and furnishes income. Business cards are a drop in this vast sea, and are, therefore, deductible as an advertising expense.

Before you get entangled in the nitty-gritty of tax filing, it’s important to create a comprehensive and in-depth marketing plan that has its cannons directly squared at your target audience.

Furthermore, always remember that marketing isn’t at any stage, a static process. It’s a continual process, with evolving needs. At some stage, you might need to turn towards press releases for its fulfillment, and other times, case studies would be more palatable. Blogs, websites, and other marketing techniques, all serve a unique purpose, that you need to get familiar with if you want your marketing strategy to succeed.

Advertising is just one page in the voluminous bundle of marketing strategies. When it comes to advertising, fee-based and public promotions work independently off each other.

There’s no denying that advertising is one of the most costly marketing strategies that a business uses.

So, how are Taxes Affected by this?

So, what does it mean in the grand scheme of things?

Well, it means that, as business cards are an advertising, or broadly, a marketing expense, you can deduct it from your tax returns.

- The tax form Section C states that an additional form must be used to report business losses, expenses and profits.

This essentially means that you will have to file your advertising and business costs on different sections of the tax return form, depending upon the nature of your business entity.

For example, if it’s a single-member LLC (limited Liability Company), the advertising expenses will come on the 8th line of the Schedule C form. The tax returns for C-Corporations and many-membered LLCS are a further cobweb of complications.

Now that you are up-to-date with what constitutes an advertising or marketing expense, you’re in prime position to save significant sums in the form of deductibles. This is your right. You’re entitled to it. And you shouldn’t let it slip under the radar.